As an acquisition entrepreneur, you need to have access to online businesses for sale. Deal flow is critical and brokers are one of the best places to find quality listings.

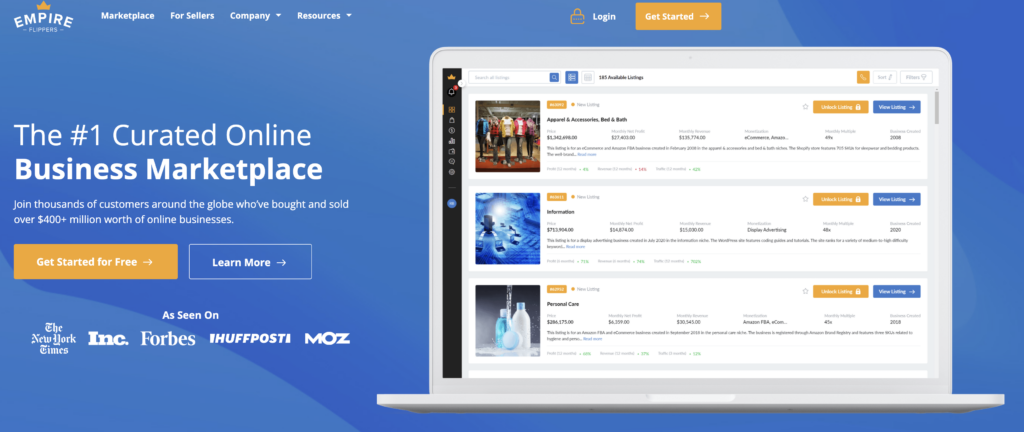

Empire Flippers is by far one of the top broker marketplaces out there with a weekly selection of eCommerce, content, and SaaS business listings.

In this article, we review Empire Flipper’s due diligence process and explain how WebAcquisition can help you vet listings to ensure the business is worthy of acquisition.

Let’s get into it!

Due Diligence Services

These firms rely on our M&A expertise

These firms rely on our M&A expertise...

Hire our team to conduct due diligence on your online business acquisition.

Get a 20-page due diligence report jam-packed with insights.

View all services, or choose your business type below:

Empire Flippers Overview

Empire Flippers is a brokerage. They take commissions on closed deals on their marketplace that range from 5% to 15% depending on the deal size. Check out their Scoreboard for metrics related to their marketplace.

In this review, we will look into their due diligence process on listings.

Empire Flippers Due Diligence Process

After a seller submits their listing, the Empire Flipper vetting team comes on the scene to collect data and ask questions.

WebAcquisition’s founder, Mushfiq Sarker, listed a content website for sale through their platform and saw firsthand the vetting process.

During the initial vetting, they have the seller fill out a detailed form asking for the business URL, revenues, questions related to the business, revenue proof, and more.

After initial vetting, the deal goes into the next stage of vetting. This is where the real analysis takes place. These are the different amounts of information collected by Empire Flippers:

- Google Analytics access to verify traffic

- Profit and loss spreadsheet creation

- Questions about the business to be answered

- Social media account list

- Proof of domain ownership

- Asset list

- Revenue screenshots

Behind the scenes, their team receives this information and performs a semi-due diligence process.

Seller-side vs Buyer-side Due Diligence

A broker ALWAYS represents the seller side. Both legally and financially they are obligated to represent the seller.

It’s in the best interest of the broker to be 100% truthful and present the deal with all data so buyers can review it. Failure to do so will result in loss of trust.

However, as a buyer, you need to perform due diligence. You need to either represent yourself or hire an M&A agency like WebAcquisition to guide you through the process.

It is critical for the buyer to perform due diligence to ensure all data matches, the deal meets your criteria, and the business is technically sound. This is called buy-side representation.

Takeaways: Brokers always have the best interest of the seller in mind. They get paid by the seller when a deal closes. A buyer needs to hire a third-party unbiased due diligence service to review the business before acquisition.

WebAcquisition’s Due Diligence Process

With a decade-plus of experience in performing due diligence, we have a very strict process for vetting businesses for sale.

Depending on the business type, we look at these criteria:

- Business revenue trends, longevity, and stability

- Marketing structure to bring new traffic (i.e., SEO, social, paid ads)

- Business model breakdown

- Niche breakdown

- Team

- P&L verification

Our team is made up of expert practitioners; each analyst runs actively a portfolio of 7-figure businesses. You can rest assured that you are getting an expert to review your next acquisition.

We Are Always On The Buyer’s Side

Most importantly, we are on the buyer’s side. We do not receive any compensation from the closing of the deal and hence are not motivated to push for the deal to close.

The buyer is hiring us as a third-party consultant to help them navigate the acquisition process.

Takeaways: WebAcquisition is an unbiased third-party M&A agency that can help you perform due diligence on your next business. We are compensated by the buyer and hence represent the buyer’s best interests.

Hire WebAcqusition To Vet Empire Flipper Listings

Buyers hire WebAcquisition to perform due diligence on Empire Flipper listings. We are the “double checkers” to ensure the business is stable, meets the buyer’s criteria, revenues match claims, and no nefarious growth tactics are used.

While Empire Flipper’s vetting is world-class, there are always specific due diligence metrics that a more seasoned team of due diligence and M&A specialists will catch.

The WebAcquisition team catches red flags that others miss.

Due Diligence Services

These firms rely on our M&A expertise

These firms rely on our M&A expertise...

Hire our team to conduct due diligence on your online business acquisition.

Get a 20-page due diligence report jam-packed with insights.

View all services, or choose your business type below: